“Taking the first step on the property ladder can be difficult. The additional costs, such as stamp duty, cause an added financial strain. Therefore, anything that reduces the cost of buying a home is a relief.

“Stamp duty is a Land Tax for a purchase of residential property or a piece of land. Prior to the abolishment of the Stamp Duty for first time buyers, when purchasing a home under £300,000 the amount of Stamp duty was 0% on the first £125,000, 2% for £125,000-£250,000 and 5% for £250,000+.

“On the 22nd November 2017, the new Autumn Budget abolished stamp duty for first time buyers on the first £300,000 of their property. This brings a relief for home-buyers purchasing a house under the value of £300,000, as the amount has been reduced to zero. And, those buying a home above £300,000 will see an 80% saving.

“However, this isn’t a fundamental change to the house market. On average, first-time buyers will save around £1,500 under the new-system which is a step in the right direction but with the house prices being high, the deposit is the key barrier.

“We welcome the announcement of the Stamp Duty being scrapped. However, the relief of this is relatively small. Of more importance is the Help to Buy scheme, which needs to continue; the Autumn Budget announced a £10 billion allocation for the Help to Buy scheme which is a step in the right direction.”

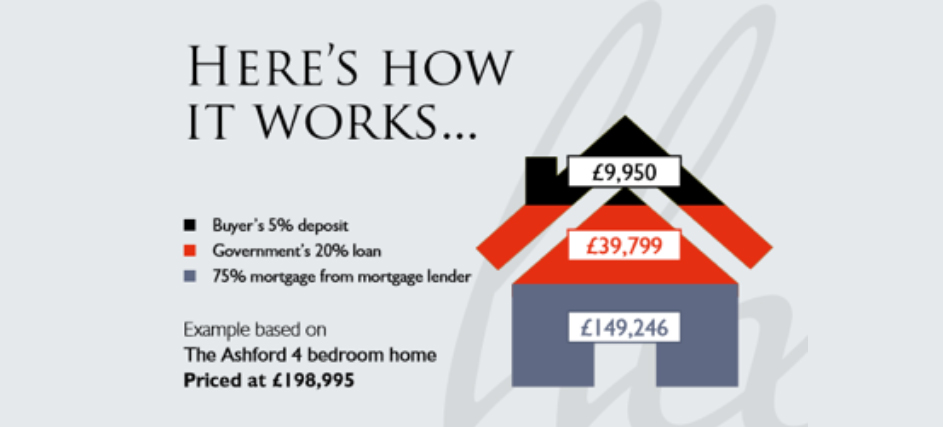

“The Help to Buy Government Backed Scheme helps individuals purchase a home with only 5% deposit. The Government Equity Loan is up to 20% of the cost of your newly build home and the remaining 75% is the mortgage”.

We offer our Help to Buy Scheme on all our properties. Get in touch and learn more today.